Contact Us

Inside the Growth of Global Wheelchair Factories: Supply Chain and Production Trends

2025-09-09

The global wheelchair industry is quietly accelerating. As populations age, chronic conditions rise, and awareness of assistive technology improves, demand for both basic mobility aids and feature-rich wheelchairs has climbed sharply. This growth is not just a matter of more units rolling off production lines — it’s a transformation across factory footprints, component sourcing, standards compliance, and distribution models. Below I unpack the major supply-chain and production trends shaping wheelchair factories today, and explain what manufacturers, purchasers and policy makers should watch for.

Demand drivers and market picture

Two big demand forces are at work. First, demographic change: aging populations in high-income markets and growing recognition of disability rights in low- and middle-income countries increase baseline need for mobility products. Second, product diversification: low-cost manual chairs, lightweight transport chairs, and increasingly sophisticated powered wheelchairs (with batteries, controllers and smart features) expand addressable markets. Market research firms report a multi-billion dollar global wheelchair market with sustained mid-single-digit to high-single-digit CAGR projections through the next decade, with manual wheelchairs still accounting for the largest volume segment even as powered chairs grow faster.[¹]

That split matters for factories. Producing millions of low-cost, reliable manual chairs prioritizes lean metal-forming, welding and simple assembly lines. Producing smaller volumes of complex powered chairs requires tighter electrical supply chains (motors, controllers, batteries), quality control labs, and often compliance with medical device regulations — a different set of factory investments.

Geographic footprint and the rise of manufacturing hubs

Historically, wheelchair manufacturing clustered around a mix of legacy makers in North America, Europe and Japan. Over the past decade, large capacity expansion and new entrants in East Asia — notably China — have reshaped the landscape. China’s assistive-product ecosystem now includes thousands of firms across manufacturing, component supply and distribution; country-level reports show rapid growth in the number of wheelchair producers and a deepening supplier base for subcomponents. This concentration brings scale and lower unit costs, but also raises questions about quality variability and the need for robust export-grade production standards.[²]

Other regions are responding. Some manufacturers are near-shoring or opening regional assembly hubs (e.g., Eastern Europe, Mexico, Southeast Asia) to shorten lead times and lower inbound freight costs for large markets. For purchasers this means a wider range of sourcing options: fully imported finished units, regionally assembled models (knock-down kits), or local production partnerships that combine design from one country with assembly closer to the end user.

Components and supply-chain pressures

Modern wheelchairs combine simple mechanical parts (frames, wheels, bearings) with an increasing share of electronic and polymer components in powered models: brushless motors, motor controllers, lithium batteries, sensors and more. The electronics and battery segments are where most supply-chain fragility appears: global semiconductor cycles, battery raw-material price swings, and shipping bottlenecks can delay final assembly even when metal-work capacity is abundant.

Factories have responded in several ways:

-

Design for supply resilience: using interchangeable motor/controller modules and simpler battery platforms so a single assembly line can accept alternate suppliers without redesign.

-

Strategic inventory buffering: holding safety stock of long-lead subcomponents while keeping finished-goods flow lean.

-

Supplier diversification: qualifying multiple component suppliers across geographies to reduce single-point risk.

Quality, standards and regulatory compliance

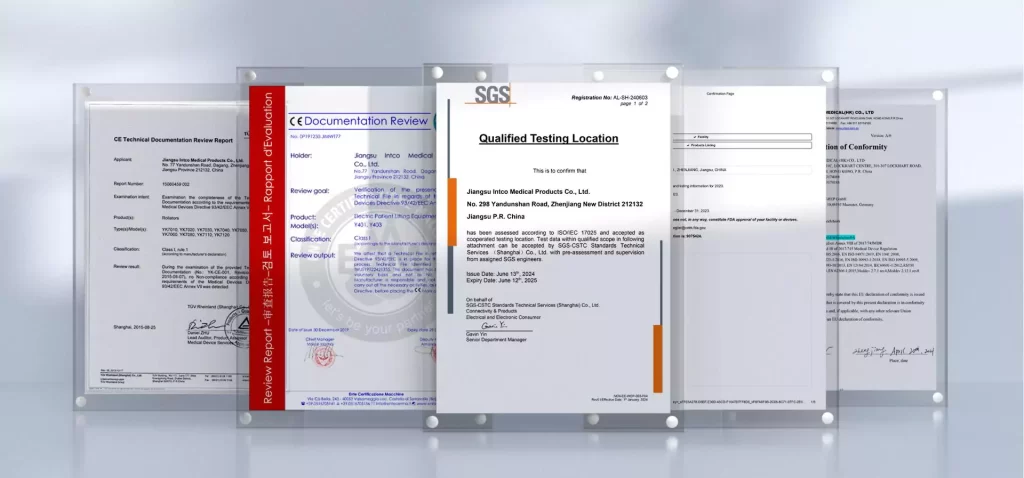

As wheelchairs impact safety and health, compliance with recognized standards is non-negotiable — particularly for powered chairs and seating systems intended for medical settings. International standards (notably the ISO 7176 series) define test methods for stability, strength, durability, and electrical safety for wheelchairs; adherence is increasingly demanded by buyers, hospitals, and procurement bodies. Manufacturers wishing to export to stringent markets usually invest in dedicated testing labs and third-party certification pathways to demonstrate compliance.[³]

Standards and certification also drive production layout and documentation: traceability systems, BOM control, and testing checkpoints become integrated into the factory process rather than optional extras. For smaller producers, meeting these requirements can be a barrier to access; for larger firms, standardization often becomes a competitive moat.

Production models: scale, modularity and customization

Wheelchair factories are adopting hybrid production models to serve divergent market segments:

-

High-volume, low-cost lines for basic manual chairs emphasize stamping, robotic welding, powder coating and fast assembly. Output and margins depend on maximizing throughput and minimizing rework.

-

Modular assembly for mid-tier models uses standardized subassemblies (frames, wheel modules, seating modules) that can be combined into multiple SKUs on the same line — lowering SKU proliferation costs.

-

High-mix, low-volume bespoke production for premium or custom chairs focuses on adjustable seating systems, individualized fittings and post-assembly clinical testing. These operations are more labor-intensive and often co-located with rehabilitation centers or clinics.

Factories that can switch between modes — for example, running high-volume cores while dedicating flexible cells to custom orders — gain resilience and market reach.

Technology adoption in factories

Manufacturers are applying Industry 4.0 practices in measured ways. Key adoptions include:

-

Digital work instructions and barcode/RFID tracking to reduce assembly errors and ensure traceability.

-

In-line torque and electrical testing stations for powered models to catch defects before final test.

-

Additive manufacturing (3D printing) for low-volume custom parts (armrests, head supports, adaptive fixtures).

-

Data analytics on warranty returns and field performance to feed design and quality improvements.

These investments are pragmatic — focused on reducing warranty costs and improving first-time-right rates rather than flashy automation alone.

Distribution, aftermarket and service networks

Production is only half the value chain; mobility outcomes depend on distribution and servicing. Global factories increasingly supply through three distribution models:

-

Direct sales to healthcare providers and distributors (common in mature markets).

-

Local partnership with NGOs and procurement agencies for bulk, low-cost chairs in lower-income settings (where WHO and national programs play a coordination role). The WHO’s Priority Assistive Products List elevates wheelchairs as essential items and helps guide procurement priorities in health systems and aid programs.[⁴]

-

Online and retail channels for consumer purchases of scooters and leisure mobility products.

Aftermarket service networks — for repairs, fitting adjustments and battery replacement — are critical for long-term usability. Factories that support a network of certified service partners reduce total cost of ownership and build brand reputation.

Policy and access considerations

Improving access to appropriate wheelchairs is as much a policy problem as a manufacturing problem. Research highlights persistent gaps in service delivery: mismatches between user needs and products, inconsistent quality, and uneven distribution channels — especially in low-resource settings. Closing these gaps requires coordination between manufacturers, health systems, NGOs and funders to ensure products are not only produced but also properly fitted and sustained.[⁵]

Policy levers also shape factory behavior: procurement specifications that reward standards compliance, subsidies for local assembly, or trade policies that influence component sourcing can direct where production capacity grows.

Conclusion

Wheelchair factories sit at the intersection of basic manufacturing and medical device production. The industry’s growth path is shaped by shifting demand profiles (aging and chronic disease), increasing product complexity (electronics and battery systems), geographic shifts in production capacity, and higher expectations for standards and service. For manufacturers, success means combining lean production for core volumes with flexible, certified processes for complex models — and investing in supply-chain resilience and aftermarket networks. For buyers and policy makers, the task is to align procurement, standards and service delivery to ensure that increased production translates into better, longer-lasting mobility for people who need it.

References

[¹]Grand View Research. (2024). Wheelchair Market Size, Share & Growth Report, 2030. Grand View Research. https://www.grandviewresearch.com/horizon/outlook/wheelchair-market-size/global

[²]Clinton Health Access Initiative. (2025). Annex 1: China assistive product supplier landscape (APMR 2025). CHAI. https://www.clintonhealthaccess.org/wp-content/uploads/2025/06/APMR-2025-Annex-1.pdf

[³]International Organization for Standardization. (n.d.). ISO 7176 — Wheelchairs (series). ISO. https://www.iso.org/standard/56817.html

[⁴]World Health Organization. (2016). Priority assistive products list (APL). WHO.https://apps.who.int/iris/bitstream/handle/10665/207694/WHO_EMP_PHI_2016.01_eng.pdf

[⁵]Shaw, S., & de Witte, L. P. (2021). Understanding the global challenges to accessing appropriate mobility devices (PMC article). BMC Public Health / Journal of Rehabilitation Research (open access).https://pmc.ncbi.nlm.nih.gov/articles/PMC8036353/